Digital Payment & Lending Platform

The Challenge

PaySecure India aimed to provide digital financial services to underbanked populations in tier-2 and tier-3 Indian cities. They needed a secure, user-friendly platform that could handle UPI payments, micro-lending, bill payments, and financial literacy features while ensuring compliance with RBI regulations and maintaining the highest security standards.

Our Solution

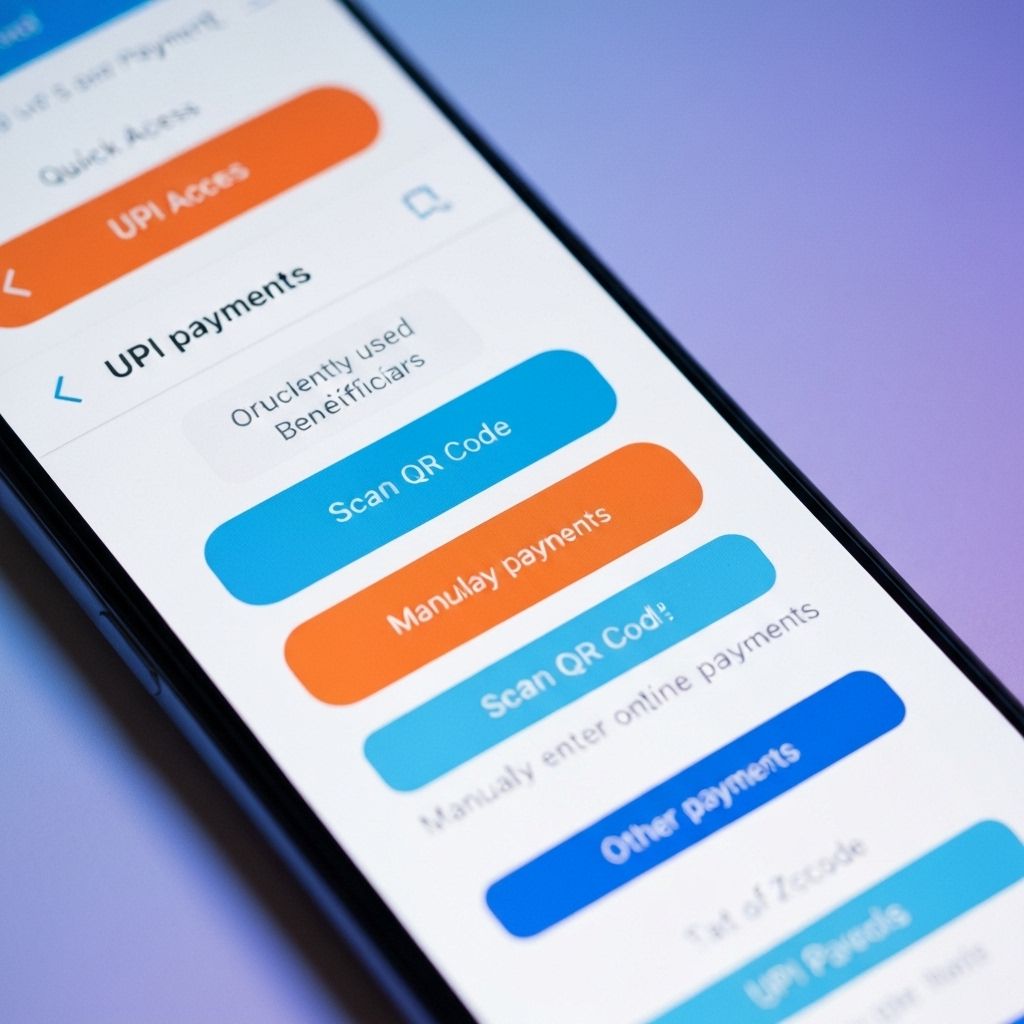

We developed a comprehensive fintech platform with UPI integration, AI-powered credit scoring, micro-lending system, bill payment gateway, financial planning tools, and educational content. The app includes biometric authentication, end-to-end encryption, and seamless integration with Indian banking systems and regulatory compliance features.

Measurable Results

What Our Client Says

"MactechHub delivered a world-class fintech platform that's transforming financial inclusion in India. Our monthly transaction volume exceeds ₹50 crores, and we've successfully served 300K+ users in smaller cities. The security and compliance features are exceptional."

Project Showcase

Secure UPI payment interface with biometric authentication

AI-powered micro-lending and credit scoring system

Ready to Transform Your Business?

Let's discuss how we can create similar breakthrough results for your project and drive measurable growth for your business.